Per Capita Income: Difference between revisions

Jump to navigation

Jump to search

No edit summary |

|||

| (4 intermediate revisions by the same user not shown) | |||

| Line 4: | Line 4: | ||

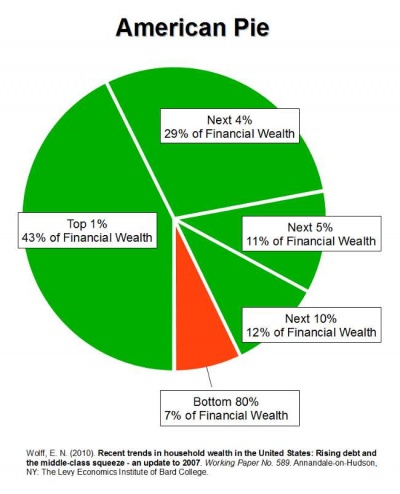

=American Pie Chart= | =American Pie Chart= | ||

Top 1% have 43% of the wealth, and bottom 80% have 7% of the wealth in 2010. Gee, is there something wrong with this picture? | Top 1% in the USA have 43% of the wealth, and bottom 80% have 7% of the wealth in 2010. Source: [http://currydemocrats.org/in_perspective/american_pie_save_130529.html]. Gee, is there something wrong with this picture? | ||

[[File:americanpie.jpg|400px]] | [[File:americanpie.jpg|400px]] | ||

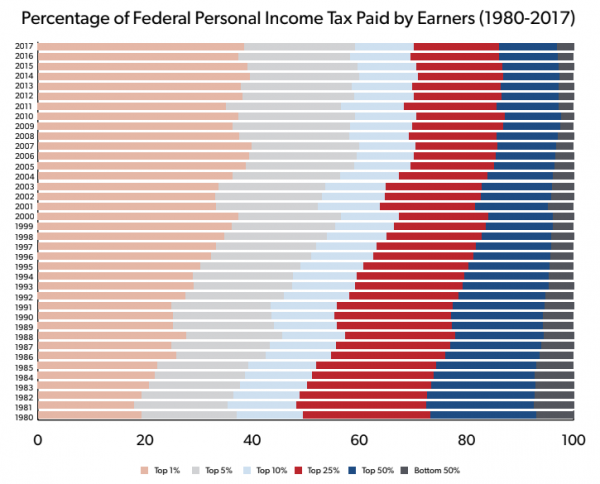

=Is Taxation Fair based on Income Bracket?= | |||

If we believe the above graph and the graph below [https://www.ntu.org/foundation/tax-page/who-pays-income-taxes] - | |||

[[File:taxbybracket.png|600px]] | |||

Then the conclusion is: | |||

'''Taxation in the USA indeed appears to be quite fair for personal income tax - because the top 1% have about 40% of the wealth, and they pay about 40% of the total income taxes.''' | |||

Is that a fair assessment? | |||

Latest revision as of 19:08, 1 July 2020

Definitions

- It includes every man, woman, and child. [1]

- Purportedly $64k in the USA [2]. This is highly misleading, as this is skewed significantly towards the upper range, as $64k for every man, woman, and child would mean everyone is living like a king

American Pie Chart

Top 1% in the USA have 43% of the wealth, and bottom 80% have 7% of the wealth in 2010. Source: [3]. Gee, is there something wrong with this picture?

Is Taxation Fair based on Income Bracket?

If we believe the above graph and the graph below [4] -

Then the conclusion is:

Taxation in the USA indeed appears to be quite fair for personal income tax - because the top 1% have about 40% of the wealth, and they pay about 40% of the total income taxes.

Is that a fair assessment?